Brands will spend $8.5 billion running ads inside games this year, inspired by their nearly universal popularity and relative brand safety, according to a new survey from the Interactive Advertising Bureau.

That said, brands still spend more money per person reaching consumers on other advertising channels, suggesting there’s additional room for growth in games-related advertising.

In 2024, the gaming industry is bigger than it’s ever been. Roughly 212 million people in the U.S. play games on a regular basis. Mobile gaming is king, bringing in an estimated $101 billion in total revenue in 2022.

Most of that game revenue still comes directly from players, not advertisers.

But perceptions among advertisers are changing quickly, eMarketer analyst Ethan Cramer-Flood said on a recent episode of the Behind the Numbers podcast.

“That’s changing now because these ads work,” Cramer-Flood said. “Obviously, mobile gaming is unbelievably popular. Everybody [plays mobile games] and now you’re starting to get higher quality ads from higher quality advertisers. The numbers are starting to get really real, to the point where now I think this is something you have to pay attention to.”

Roughly 32 percent of advertisers say game-related ads are “excellent” at driving brand awareness, because they engage people while they’re immersed in a game. Advertisers rank just two other channels—social media and digital display ads—higher, according to the IAB report.

Some 86 percent of advertisers say games represent a brand-safe advertising channel—ranking it the second highest-rated channel for brand safety, behind digital audio, which includes streaming music and podcasts.

So why aren’t brands spending more money running ads alongside games?

One of the leading challenges is access: The majority of game advertising transactions still involve negotiations between the advertiser and the publisher in some form. Nearly one-third of transactions are programmatic guaranteed, where games publishers guarantee a specific number of advertising impressions at a fixed cost. Roughly 30 percent of transactions are direct deals, negotiated with the publisher’s sales representatives.

Another 20 percent of transactions occur on private marketplaces, which are invitation-only platforms where games publishers invite specific advertisers to bid on their inventory. Just 17 percent of games advertising transactions today occur on open exchanges, where any advertiser can bid on available advertising inventory, according to the IAB report.

By comparison, 91 percent of all digital display ads worldwide are purchased today on programmatic platforms, with fewer than 10 percent of advertising deals happening directly, according to analysts at eMarketer.

Another big challenge is inventory: Mobile games are the most popular medium for games-related advertising because consumers expect to see ads inside free-to-play games. As a result, there are millions of available ad units each day inside mobile games.

Consumers haven’t been conditioned to see ads on PC and console games, so there are fewer available ad units there. Roughly 3 out of 4 advertisers surveyed said they bought ads on mobile games, while just 1 out of 4 said they bought ads on all three gaming media platforms—mobile, PC, and console.

The final challenge is financial: Mobile games have one of the highest 30-day churn rates among mobile apps. If 100 people download a mobile game on the same day, just 2 people from the group will still be playing that game 30 days later, on average.

Looking at Android games specifically, it costs an average of $1.10 to acquire a new customer, which means publishers have a short window to make $1.10 or more in revenue per customer, so they generate enough money to fuel new downloads, and pay for ongoing operational costs.

As a result, game publishers prefer rewarded video ads, which pay high CPMs. The challenge is that rewarded video ads are largely used by other app developers, who are trying to generate mobile downloads themselves.

In 2024, traditional brands still believe that buying ads on digital games takes too much effort to plan and buy.

Asked to rank the ease of buying ads across six different media channels, digital games ranked close to last, with digital display, social media, digital audio, and CTV ranked higher for perceived ease of use, according to the IAB report.

For years, major brands and advertisers have relied on Start.io to provide them with high-quality audience segmentation.

For example, if your next ad campaign is targeting high-income families in the New York City metro area who are interested in vacationing in Europe, we can help, by building an audience based on income, location, and interests.

In total, we offer marketers more than 800 distinct audience segments, which they can activate on virtually every major ad-buying platform.

Start.io uses artificial intelligence to build its audience segments at scale, by studying more than 20 mobile signals that we routinely gather from roughly 2.5 billion mobile devices each month. These privacy-compliant mobile signals include things like the user’s location, their mobile app preferences, device type, mobile keyboard language, and others.

For the past year, Start.io’s R&D team has been training our artificial intelligence models to analyze additional signals embedded in the data, to achieve even greater accuracy.

We’ve experienced significant breakthroughs in this work, resulting in some of our most popular audience segments doubling or tripling in size. Here’s how:

Our original AI models built audience segments based on deterministic data—defined as information that is concrete and observable, such as a user’s current location, device type, or the mobile app they’re using.

Start.io’s first-party data is robust and contains enough contextual information for our original AI models to build audience segments with a high degree of confidence.

Our new AI models find additional patterns in the data using neural networks, a subset of machine learning that processes information like a human brain. We’ve initially focused on improving predictions around a consumer’s age and gender.

We train our neural networks using a multi-stage approach, involving several layers of processing to refine a prediction’s accuracy.

In the first stage, raw data from different mobile apps and data sources is collected and pre-processed to extract relevant demographic attributes. Once the data is pre-processed, it is fed into a neural network that helps us convert any mobile app into a vector of numbers. That information is then fed into machine learning models that have been trained to classify the user’s age and gender.

After a year of R&D, training, and testing, Start.io is confident in its ability to predict age and gender at greater scale. This breakthrough is immediately valuable for our customers because we’re now able to double, and in some cases triple, the size of our age- and gender-related audience segments in the market today.

Neural networks continuously learn and adapt to evolving trends in user behavior. Neural networks are trained to incorporate new datasets into existing models, ensuring that demographic predictions always remain fresh and relevant.

Unlock new levels of precision in audience segmentation with Start.io. Contact us to learn more.

Have you binged anything good lately?

The average American spends a little over 2 hours per day watching videos on connected TV (CTV) apps like Netflix, Amazon Prime, Disney+ and others. That’s roughly double the amount of time spent on CTV apps just 5 years ago.

And yet, despite its maturity (Netflix launched its streaming service 17 years ago) CTV is still relatively early in its journey as an advertising medium.

Start.io executives recently attended CTV Connect; here’s a recap of their five biggest takeaways from the conference:

#5: CTV is big and growing (duh)

Virtually everyone in America is watching CTV. It’s now estimated that 93 percent of internet-connected American households have at least one CTV app they watch on a regular basis.

Meanwhile, cable TV subscriptions have declined sharply, from a high of 105 million American households in 2010 to an estimated 53 million households by 2028, according to analysts at Digital TV Research.

Despite that growth, CTV subscribers generate a fraction of the revenue cable TV subscribers do. Cable TV viewers watch an estimated 15 minutes of ads per hour. CTV subscribers watch far fewer ads—ranging from 3 minutes to 9 minutes of ads per hour, according to eMarketer.

And despite the recent launch of ad-supported versions of most major CTV apps, ad-free subscriptions remain more popular, at least for now.

#4: People don’t hate ad-supported CTV

CTV publishers monetize by offering:

- A monthly subscription plan without ads

- A free service with ads

- A lower-cost monthly subscription with occasional ads

An estimated 80 percent of consumers subscribe to one or more ad-supported CTV services, according to a 2022 survey by LG Ads Solutions.

Given the choice, more than 60 percent of people say they’d choose an ad-supported CTV app to save money, rather paying for the more expensive, ad-free version of the same app.

That’s music to publishers’ ears, as they can generate more revenue per month from ad-supported subscribers than ad-free subscribers.

Free, ad-supported streaming TV (FAST) is growing rapidly, with free services like the Roku Channel, Amazon Freevee, Viacom’s Pluto TV, Xumo, and Tubi.

Ad-supported streaming services have room to improve their revenue mix, by running more ads per hour and/or by targeting households more effectively to increase CPMs. Consumers seem to receive changes to ads more positively than when monthly subscription rates increase.

#3: CTV subscribers are fickle

Chances are, you’ve subscribed to a streaming service, later canceled it—and maybe even returned to that same service later.

CTV streaming apps lose an average of 3 percent to 12 percent of their subscribers each month, according to analysts at Antenna.

The five biggest reasons?

- People want to saving money

- They finished watching the shows they liked

- They couldn’t find new content to watch

- The service’s promotional pricing offer ended

- The service raised its subscription price

Content discovery remains a persistent pain point for CTV subscribers. Unlike short-form videos, starting a new show on a CTV service involves a heavy commitment of time and attention.

CTV services promote a fraction of their catalog to subscribers, and streaming recommendations can start to feel stale over time.

In December 2023, Netflix revealed it had around 4,500 globally available titles on its platform at the time (with another 13,700 titles available in select regions only). Most people will only ever see a few hundred titles through Netflix’s recommendation engine.

The average person spends 6 minutes trying to figure out what to watch when they land on a CTV app, according to LG Ad Solutions. This 6-minute window could be a prime place to serve ads, several people told us at CTV Connect.

#2: CTV ads aren’t like other ads

CTV subscribers expect a lot from the CTV ads they watch. They want to see visually interesting, TV-quality ads that make good use of the real estate on their big screen TVs. TV-quality ads can cost $10,000 to produce on the low end, and many tens of thousands of dollars on the high end.

Advertisers need to aim their messaging at a household level, rather than an individual level—an estimated 88 percent of people say they watch CTV with at least one other person in the room with them.

That isn’t a problem for the big, national brands that spend hundreds of millions of dollars each year on linear TV ads. Big brands are comfortable with nebulous measurements of advertising success, and don’t have the same expectations for consumer targeting and performance as smaller, sales conversion-focused brands.

#1: Squishy performance metrics have smaller brands wary of CTV

In 2024, brands are increasingly demanding CTV apps give them measurable performance metrics, so they can calculate return on ad spend (ROAS).

Calculating ROAS is far easier with mobile and desktop ads—advertisers can instantly measure clicks and conversions, allowing them to optimize an ad campaign on the fly.

Performance measurement is harder on CTV. Some advertisers have tried to measure attribution by showing QR codes during their CTV ads, encouraging people to take out their smartphones to navigate to a webpage to sign up for a service, or buy something.

Other advertisers have instead relied on IP addresses for attribution. A quick primer on IP addresses: Every Wi-Fi router has a unique IP address that it shares with the devices that connect to the internet through that router. People periodically reset their Wi-Fi routers; when they do, their router will come back online with a new IP address.

CTV apps gather IP addresses where it’s permissible by local privacy laws and pass that data on to advertisers, who can use it to see if a smartphone or laptop computer with the same IP address later logged onto their website.

IP address-based attribution is increasingly under pressure—IP addresses are considered protected personal information under privacy regulations in Europe, California, and a handful of other U.S. states.

Local companies and smaller brands need to see precise targeting capabilities, audience segmentation tools, and more robust performance metrics before committing to spending money on CTV ads.

What does your company know about me?

I’ve bought a lot of baby products over the past two years, and I like watching action movies in the evenings. My phone and computer know that I’m usually home during normal business hours, and I’ve been doing a lot of research recently on table saws.

Combining these clues, you might guess I’m a dad with a young toddler, I work from home, and I’m planning to buy some expensive woodworking equipment soon.

There has always been a massive business opportunity for companies that can (a) successfully gather consumer data from different sources, (b) combine the data to build an accurate consumer profile, and (c) use the data to send people targeted ads based on their interests.

In a post-cookie world, the solution to this challenge will likely be “hedged gardens,” where technology platforms, publishers, and brands add their respective slices of consumer data, combine it in a data clean room, and build a more open alternative to the “walled gardens” owned by Amazon, Google, Apple, Meta, and other tech giants.

Hedged gardens were a big theme at RampUp 2024, the annual conference organized by the data collaboration platform LiveRamp. We attended the conference, and had great conversations with our partners about the future of privacy-compliant consumer identity—here are our big takeaways:

Privacy and the death of third-party cookies remains top-of-mind for advertisers and the ad tech platforms that serve them. But at RampUp 2024, people seemed confident that the industry would come together to build an alternative to the walled gardens that currently dominate the advertising landscape.

This will require everyone bringing their slices of consumer data, combining them in a data clean room environment, and tying them to an alternative identifier, such as LiveRamp’s RampID. The goal is to build robust, privacy-compliant, anonymized consumer profiles that can achieve accurate ad targeting for cross-device use cases.

Anecdotally, we spoke to publishers at RampUp who said they’ve seen 30- to 100 percent higher CPMs from users who are tied to an alternative identifier.

The brands we talked to seemed more pragmatic about identity—they said they’ll use the identity platform that works the best. They’re happy using a platform that relies on mobile advertising IDs and third-party cookies if it delivers the best results today, even if the identifiers the platform relies on will eventually disappear.

Overall, there was optimism that the ad tech industry would come up with a privacy-compliant solution for alternative IDs that would meet the performance and regulatory benchmarks set today by cookie-based identities.

And while ad tech platforms rapidly test, refine, and launch their own hedged gardens, advertisers said they are content to take a wait-and-see approach, confident that they would be able to continue targeting consumers based on their interests after the death of the third-party cookie.

The big takeaway? Post-cookie, Google’s Privacy Sandbox initiative will be one solution among many—and early tests of hedged gardens suggest that great alternatives exist.

In 1994, the very first banner ad appeared on the internet. Thirty years later, there are billions of digital ads served online every day. More than 80% of them are programmatic display ads.

‘Programmatic’ is a term describing the complex process of computerized, algorithmic ad buying that fuels the digital ecosystem. Programmatic ad technology is the preferred method advertisers use to buy display ads, mobile ads, in-app ads, digital out-of-home ads, audio ads, and connected TV ads.

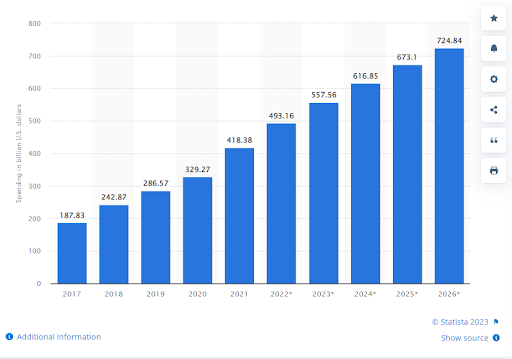

Advertisers spent an estimated $558 billion on programmatic advertising in 2023. By the year 2026, industry experts expect advertisers to spend $700 billion on programmatic ads.

Source – Statista

Programmatic advertising is growing quickly because it solves significant pain points for both sides of the transaction: Advertisers and content publishers.

Join us for a deep dive into the programmatic advertising ecosystem, how programmatic advertising works, the benefits, latest programmatic trends, and more.

What is programmatic advertising?

Programmatic advertising is the automated process of buying and selling ad placements in the digital ecosystem. Programmatic media buying connects content publishers and advertisers in real-time auctions for ad space on websites, apps, and any other digital screen where ads are placed.

Unlike traditional media buying, which involves a lot of complex and time-consuming manual work, programmatic buying enables centralized, automated, algorithm-based bidding on multiple publishers’ sites, so advertisers can win the best ad impressions at the best possible price for their target audience and campaign goals. For publishers, programmatic advertising helps drive website and mobile monetization by filling ad inventory automatically and in real time with the most suitable ads, with far less effort.

How does programmatic advertising work?

Every day, billions of ads are served on desktop, mobile and digital TV screens all over the world. Programmatic advertising automates the complex process of connecting thousands of advertisers and publishers in real-time auctions for available ad space, filling the space and serving ads instantly to the user.

Programmatic advertising relies on several online systems that connect with one another to make the media buying process happen. Let’s look at those systems and how they work together.

- An advertiser is looking to purchase ad space to promote their product or brand, so they turn to a trade desk or programmatic ad agency. These programmatic advertising companies use a demand side platform, or DSP, which automates the bidding and buying process on behalf of the advertiser.

- The DSP connects the ad agency to multiple publishers at once, bringing a wide range of options for where the ad might be placed. With the help of a data management platform, or DMP, the DSP analyzes audience data based on a range of parameters, such as geographic area, user behavior, and demographics, to decide which ad placement to bid for, and at what price.

- On the publisher side, there is the supply side platform, or SSP. Via this platform, publishers can supply ad inventory for DSPs to bid on. When a user lands on a website, the website sends a request to the SSP, the SSP connects to the DSP, and a micro-auction begins. The DSP bids on behalf of advertisers, using the DMP to decide which ads are best suited to the publisher’s visitor, and the ad placement is filled by the most suitable ad at the highest bid.

This entire process happens within the seconds it takes for the user’s website page or mobile app to load. For both sides of the transaction, programmatic advertising takes the manual work out of digital media buying and selling, while making it more optimized and efficient. In a complicated and constantly dynamic marketplace, programmatic advertising is a win-win for publishers and advertisers alike.

What are the 4 main types of programmatic advertising?

Programmatic advertising comes in several variations. Here are the 4 most common types of programmatic advertising used in the industry today:

Real-Time Bidding (RTB)

Real-time bidding is a type of programmatic advertising where advertisers compete for ad inventory in auctions conducted in real time. RTB operates with the CPM (cost per mille) model, meaning that advertisers set their bid and pay publishers for the ad space per 1,000 impressions.

Private Marketplace (PMP)

Private marketplace, or PMP, is a type of programmatic advertising that takes place in a closed auction, where a set of exclusive advertising partners participate. It provides advertisers with access to unique ad inventory that is not available on open exchanges. PMP enables publishers to tailor their inventory and provide specialty offerings to advertisers, giving them the opportunity to build relationships with advertiser partners.

Preferred Deals

A preferred deal is a programmatic buying method where the publisher and advertiser negotiate a price to purchase ad space. The media buyer gets preferential treatment, in that they are offered the opportunity to bid at the agreed-upon price. However, preferred deals are not guaranteed–the publisher does not need to hold the ad space at that price for the advertiser, and the advertiser is not obligated to bid for the space.

Programmatic Guaranteed

Programmatic guaranteed is when a publisher and advertiser negotiate the cost and terms of a particular ad inventory, and that inventory is reserved for the specific advertiser at the agreed-upon price.

What are the most common programmatic ad formats?

Programmatic advertising is used to buy and sell digital ad space for a wide range of formats and channels. Here is a quick overview of the ad formats that are available programmatically:

Display ads

Display ads, or banner ads, are ads that appear on desktop and mobile websites. They typically appear at the top or sides of a web page. Programmatic display is one of the most common types of digital advertising, as it offers an affordable and accessible way to reach large audiences. Despite their widespread adoption across the industry (or perhaps because of), display ads typically have relatively low clickthrough rates.

Video ads

Programmatic video advertising is a popular method for buying and selling video ad space, particularly for apps, connected TV and social media. Video is an effective advertising tool, generating higher engagement among audiences than simple display ads.

For example, a user completes a level on a gaming app and is about to move to the next level. The app publisher might provide a video ad here, during this transition between levels. Advertisers selling a product that is relevant to the user demographic can bid programmatically for this ad space and show a video ad that is likely to pique the user’s curiosity at this prime moment, when the user is enthused and engaged.

Social ads

An estimated 62% of the world’s population is on social media. Social programmatic advertising is a powerful tool to reach a vast audience efficiently and target them using their social graph and interests. Advertisers use DSPs to bid programmatically for ad space on social networks such as Facebook, Instagram, X (formerly Twitter), LinkedIn, Snapchat, TikTok, Reddit and more.

Native ads

Native ads are designed to fit the form and feel of the web page they appear on. Native ads are less disruptive than display ads, and users tend to “see” them more than other ad types. By partnering with a programmatic trade desk, advertisers can access native ad inventory programmatically, taking advantage of the more advanced targeting options that native ad exchanges typically offer, such as contextual targeting.

Audio ads

The digital audio industry has experienced rapid growth in recent years. Roughly 42% of Americans aged 12+ report they listened to a podcast in the last 30 days, according to a survey from Edison Research. An estimated 90 million Americans—or roughly 1 out of 4 people—now pay for a streaming music subscription, Forbes reports. Advertisers can bid programmatically for digital audio ad space on platforms such as podcasts, music streaming apps and digital radio.

Digital out-of-home (DOOH)

Digital-out-of-home advertising includes digital billboards and screens positioned in public spaces. DOOH is an important part of an omnichannel advertising campaign, as it enables brands to reach customers when they are out and about, and not on their phones or computers. With programmatic advertising for DOOH, advertisers can bid automatically for this important ad space at the most effective times and locations.

In-app programmatic advertising

In the U.S., people spend an average of 4 hours and 25 minutes a day on their phones, making in-app advertising an attractive option for advertisers. Mobile programmatic advertising works the same way as programmatic advertising on the web, however in-app ads have unique formats and sizing to fit the smaller mobile screen. The main ad formats for in-app advertising include interstitial ads, banner ads, splash ads, rewarded ads, playable ads and rich media ads.

What are the benefits of programmatic advertising?

Programmatic advertising has benefits for both advertisers and publishers. Here’s why:

Reach

Programmatic advertising connects advertisers with tens of thousands of publishers at once, so the potential audience reach across platforms is far larger. For publishers, the programmatic method makes their ad inventory available to an enormous pool of advertisers, increasing the competition for placements and boosting revenue. This is a good tactic for web and app monetization.

Omnichannel targeting

One of the biggest challenges for marketers today is generating audience awareness across several touchpoints, including desktop web, mobile web, apps, digital-out-of-home, and connected TV. Programmatic advertising enables advertisers to bid for optimal placements on all platforms in real time and build an effective multi-channel advertising strategy.

Automated tasks

Automation takes most of the legwork out of the online advertising process, making it simpler and easier to manage. More importantly, by eliminating most of the rote tasks of ad bidding, buying and placement, programmatic advertising frees up advertisers to focus their resources on audience research and strategic optimization to get more from their campaigns.

Real-time results and optimization

Data transparency is a huge benefit of programmatic ads. By tracking campaign results in real time, advertisers are better positioned to optimize ads effectively and get better results from their campaigns faster. Furthermore, the transparency afforded by programmatic platforms enable advertisers to assess publishers in real time based on ad performance and avoid low-quality and fraudulent placements.

Better ROI

Automation, data-based insights, and enhanced optimization capability in real time all add up to higher return on investment for advertisers. Programmatic advertising enables advertisers to keep a finger on the pulse of multiple campaigns running on several platforms in one centralized operation, so they can make optimization decisions faster, and get better return on ad spend.

Improve ROI by following programmatic advertising best practices

By keeping up with programmatic best practices and mastering the latest hacks and tools, advertisers can maximize their campaign potential and ROAS. Let’s look at the programmatic advertising best practices you should follow today:

Align your goals to ad type and channel

All digital campaigns should be based on specific goals and KPIs, and this is no different for programmatic ads. To achieve the best possible performance, make sure to define and align the objective of your ad campaign to the programmatic channel and ad type. For example, the campaigns for programmatic display and in-app ads will have very different creatives and KPIs, even as they promote the same product or service.

Segment your audience

By grouping your audience into user segments based on their location, online behavior, interests, or marketing funnel stage (awareness, consideration, conversion), it will be easier to target them with programmatic ads that offer the right message at the right time. Explore your web and mobile audiences to understand them better, identify their pain points and segment them accordingly. Then you can use programmatic methods to target and optimize ad campaigns in real time to the best potential segments.

Use data to drive decisions

With programmatic, advertisers have access to a broad set of real-time data across all campaigns and channels, to understand which ads are performing best and why. Advertisers should take full advantage of this information to make smart and accurate decisions about campaign targeting and optimization, to get better ROI for their ad spend.

Test and optimize

Programmatic advertising is the ideal platform to test and optimize campaigns to drive better performance over time. Use the fast-moving pace of programmatic to your advantage by frequently A/B testing campaigns and optimizing in real time according to the results.

Use an omnichannel approach

Programmatic advertising works best with a multi-channel approach, targeting audiences on different channels at different times. By reaching out to audiences across multiple touchpoints and media, such as mobile web, video, apps, out-of-home, connected TV, retargeting, and more, you can access a larger pool of data that can be used to test campaigns and scale them for the best results.

Programmatic advertising trends for 2024

The programmatic advertising ecosystem is developing exponentially, supporting scale and performance potential that was unheard of in the early days of RTB auctions. Let’s explore some of the programmatic advertising trends that have the industry buzzing now:

Contextual signals > cookies

Digital advertising has traditionally relied on third-party cookies to identify and target suitable audiences. With cookie depreciation on the horizon, this will soon no longer be an option. Programmatic advertising is trending toward contextual targeting of first-party data, in which audiences are grouped according to interests and shown relevant ads. Contextual signals, such as content topics, page categories and lookalike audiences, will be the future of programmatic targeting.

The rise of omnichannel ads

The shift towards an omnichannel programmatic advertising strategy is already happening and will only accelerate in the future. Brands are operating in a highly competitive marketplace where grabbing consumer attention is tougher than ever before. Programmatic ad technology enables advertisers to better craft, promote and optimize campaigns across all channels, automatically, and in real time.

AI in programmatic advertising

Artificial intelligence and machine learning are rapidly advancing, and will be increasingly adopted in programmatic advertising to support even better ad targeting and optimization. Predictive AI will enable advertisers to pinpoint high-potential users with better accuracy and serve personalized ad experiences at a more granular level. Combined with the dynamic speed of programmatic advertising, advertisers will ramp up their performance at unprecedented precision and scale.

Check out our Programmatic Curation Guide for Advertisers and Publishers to learn how machine learning can drive personalization and better campaign performance.

How to get started with programmatic advertising?

There are numerous programmatic advertising examples and platforms for web, mobile, DOOH and CTV. Although similar, each has its own features, tools, and processes. Start.io supports mobile programmatic advertising, with more than 500,000 integrated apps and vast global reach of mobile audiences.

Download the Start.io advertising SDK today to monetize your mobile app.

If you’re finding yourself single this Valentine’s Day, you’re not alone: Roughly 9 percent of Americans are walking around with at least one dating app installed on their phone, according to a new data analysis from Start.io.

For this analysis, we studied an anonymized sample of 12.2 million Americans with Android phones and found that a little over 1 million people in the sample had at least 1 dating app installed. Note: This analysis only studied download data and did not study open rates or session length.

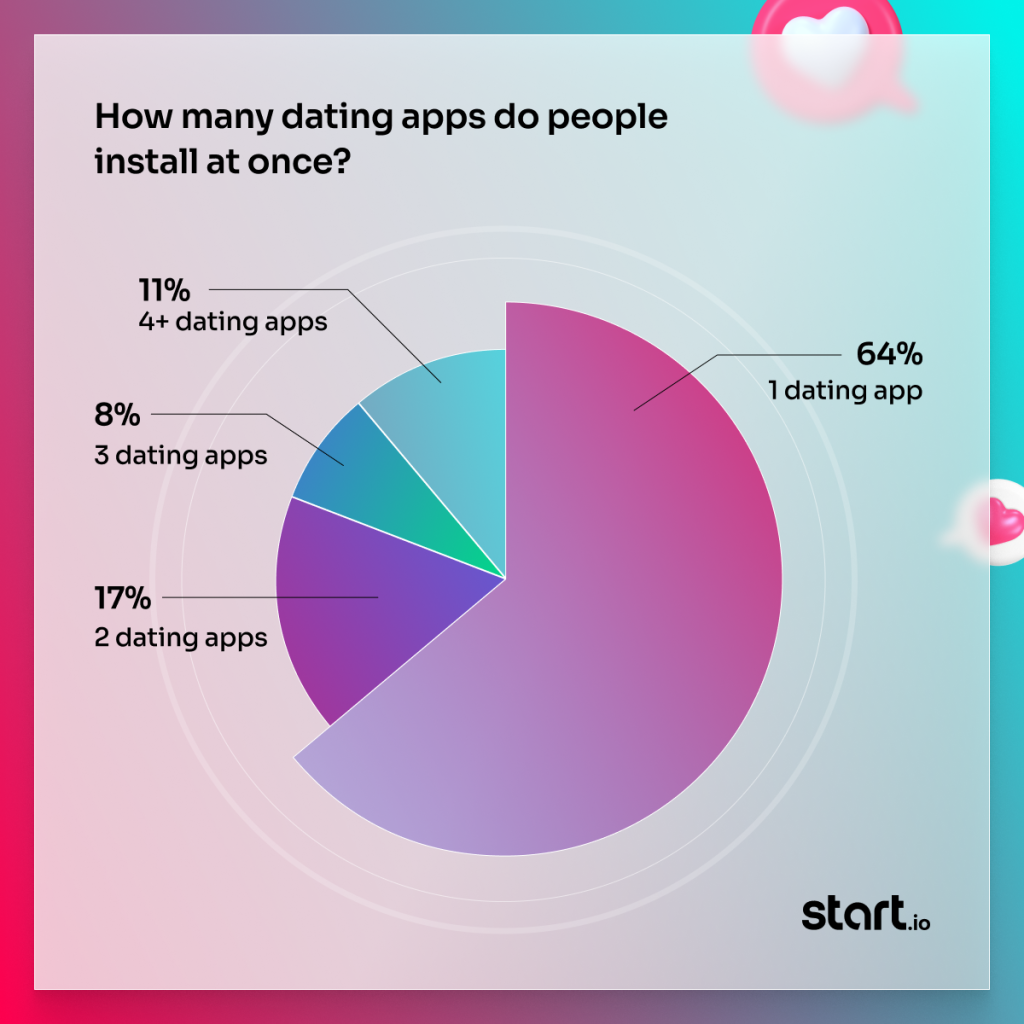

Most people have just one dating app installed, and chances are, that app is Tinder. Here is a chart of how many dating apps people have installed, on average:

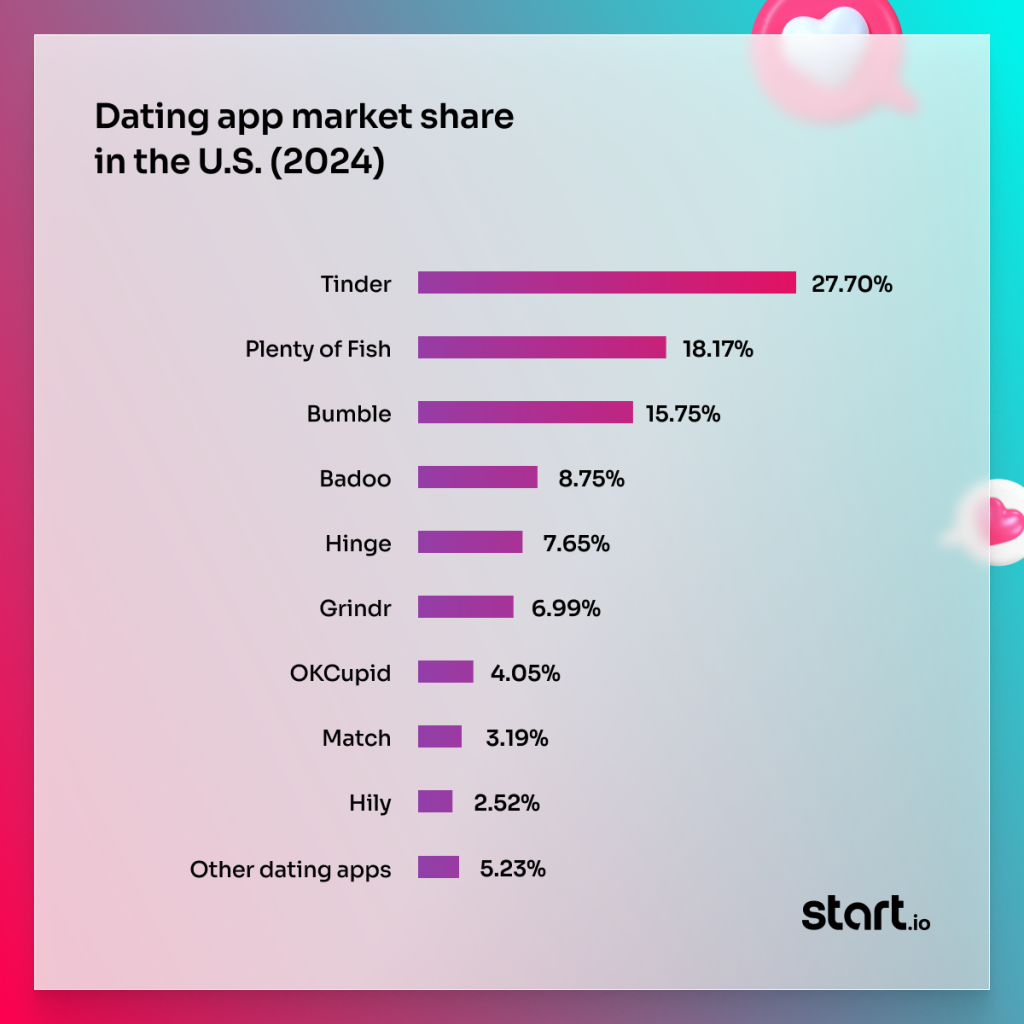

It’s estimated that there are more than 1,500 dating apps in use today, by more than 300 million people worldwide. In the United States, 85 percent of the mobile dating market is owned by just 6 apps: Tinder, Plenty of Fish, Bumble, Badoo, Hinge, and Grindr.

Several hundred dating apps make up the remaining market share, according to Start.io’s analysis. Note: To estimate approximate market share, we studied an anonymized sample of 934,000 dating app downloads in the United States across 50 states.

In our analysis, we focused on 19 leading dating apps—a list we compiled by analyzing the 10 most-downloaded dating apps in each state.

Who uses dating apps?

Not surprisingly, dating apps are most popular with people aged 25- to 34. People who use dating apps are twice as likely to enjoy consuming sports content than the average American consumer. They also have a lower income than the average American, and are more likely to use transportation apps, such as public transit apps, ridesharing apps, and flight booking apps.

Dating apps are downloaded more often by men than women. In our data sample, we found that 62 percent of all dating app downloads came from men, while 38 percent came from women.

About us

Start.io is an omnichannel advertising platform that delivers more than 300 million ads per day. More than 500,000 mobile apps have installed the Start.io advertising SDK. We process billions of first-party data points each day, which we use to build consumer insights and audience segments for our brand partners.

Click here to activate the Start.io audience segment Dating App Users in the United States.

Cookies—or rather, the lack of cookies—loomed large over the Interactive Advertising Bureau’s 2024 Leadership Meeting, which traditionally marks the official kickoff of the year for the advertising industry.

Several of Start.io’s senior leaders attended the Annual Leadership Meeting, which was held in late January in Florida. Here are their big takeaways from the conference.

Advertisers aren’t prepared for the end of third-party cookies

In early 2024, Google permanently turned off third-party cookies for an estimated 30 million people—roughly equivalent to the population of Texas. The company says it plans to turn off third-party cookies on Chrome for everyone by the end of the year.

IAB, which serves as the leading trade association for the advertising industry, has repeatedly warned Google that advertisers aren’t ready for the death of third-party cookies.

At the Annual Leadership Meeting, IAB gave Google an early look at a gap analysis report containing dozens of real-world examples from advertisers who had tested Google’s Privacy Sandbox and found it didn’t support critical advertising functions they use today.

IAB has since published a 106-page draft of the report and will gather comments on the report until March 22.

“In its current form, the Privacy Sandbox may limit the industry’s ability to deliver relevant, effective advertising, placing smaller media companies and brands at a significant competitive disadvantage,” the report reads. “The stringent requirements could throttle their ability to compete, ultimately impacting the industry’s growth.”

At IAB’s Annual Leadership Meeting, Google organized an event focused on Privacy Sandbox and the deprecation of cookies in the browser, and mobile advertising IDs on Android.

We attended that event and spoke to Google representatives who assured us that the company is working on a solution that won’t hurt the mobile advertising ecosystem, while supporting users and their private data on Android.

Related: Read our thoughts on how Privacy Sandbox will impact Android app developers.

AI and ML are rapidly reshaping the ad industry, with unanswered ethical questions

Artificial intelligence has already revolutionized how hundreds of millions of digital ads are bought and sold every day. In 2023, artificial intelligence began moving up the creative stack, and we saw early experiments in generative AI capable of creating ads on its own.

This remains a huge gray area for the advertising industry. We had thought-provoking conversations with our peers about the ethics around automated content creation and hyper-personalization in ads.

As generative AI gets better, it may begin pushing out creatives at ad agencies, particularly at the lower end of the billing range.

Artificial intelligence promises to generate personalized ads at scale—delivering retail product recommendations with pinpoint accuracy, or tailoring brand messages to match a consumer’s current mood. This too, remains an ethical gray area.

Diversity in ad targeting

There is a certain amount of trust that brands place in the hands of the adtech industry, which promises that their ad targeting capabilities will help them reach specific audiences.

We attended thought-provoking sessions around diversity and inclusivity, where brands wondered whether they can really reach the audiences they want, or whether adtech companies are manipulating programmatic ad campaign execution around diverse reach.

Finally, CTV

Connected TV promises to deliver the reach of cable TV with the personalization of digital ads. It seems like every major streaming app has already launched (or plans to launch) a cheaper, ad-supported subscription tier, opening the door for millions of new CTV ads.

In 2024, brands are no longer happy with the “spray and pray” approach they took with linear TV and want precision targeting. The reality is that measurement, attribution, and targeting remain big hurdles to solve with CTV.

What were your big takeaways from IAB ALM 2024? Tag us on LinkedIn and include the hashtag #iabalm

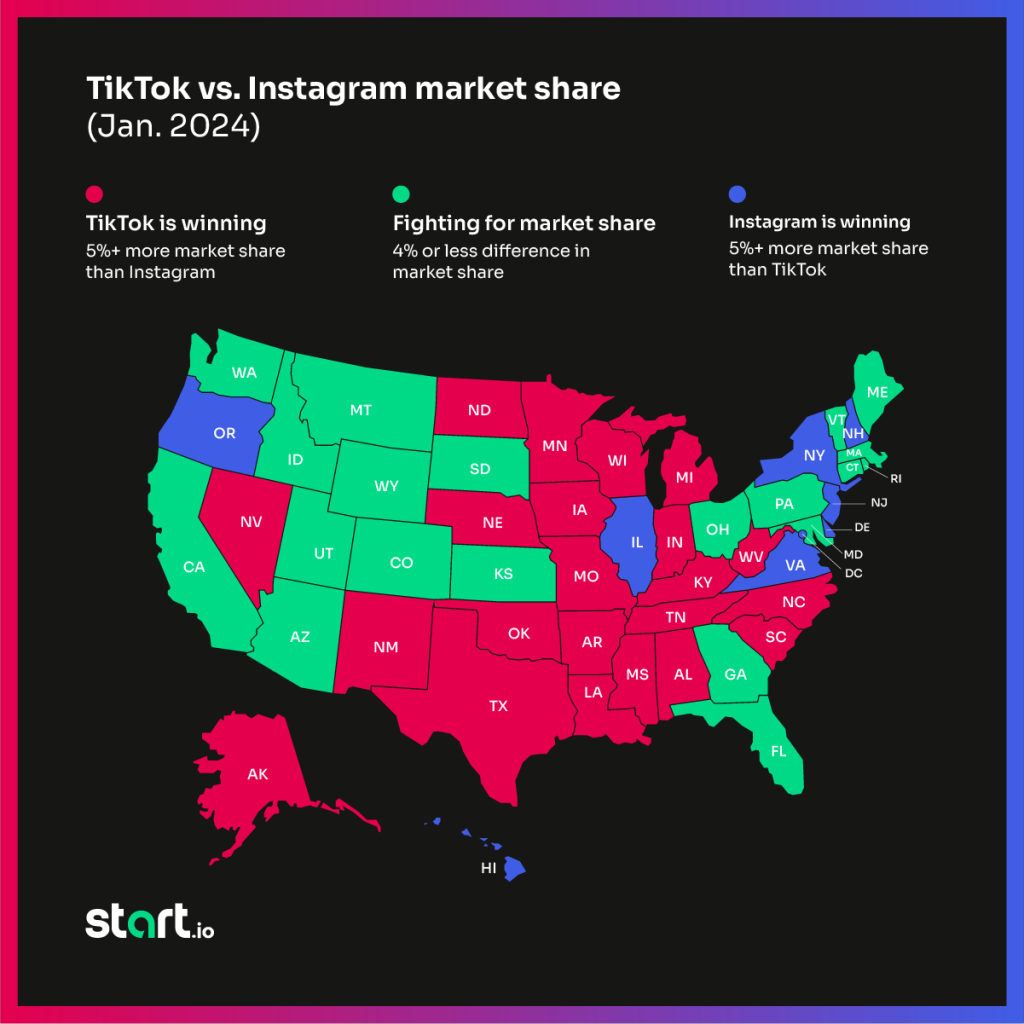

TikTok and Instagram are locked in a war for market share in the United States, and TikTok is winning, according to new data this week from Start.io.

Start.io studied an anonymized sample of 11 million Americans with Android phones, to estimate the relative market share of TikTok, Instagram and Facebook, based on app downloads. Start.io studied total downloads but did not study mobile app open rates or average session length (Read more about the dataset toward the end of this article).

TikTok is most popular in Nevada, where the app has been downloaded by an estimated 50 percent of smartphone users. It’s least popular in Delaware, where it’s been downloaded by just 20 percent of people.

Both TikTok and Instagram trail Facebook, which has been downloaded by roughly 62 percent of Americans nationwide.

Top 5 states where TikTok is most popular:

|

State |

TikTok download rate |

Instagram download rate |

|

Nevada |

50% |

32% |

|

Kentucky |

44% |

31% |

|

Mississippi |

44% |

32% |

|

Alabama |

44% |

33% |

|

Louisiana |

44% |

35% |

Top 5 states where Instagram is most popular:

|

State |

Instagram download rate |

TikTok download rate |

|

Delaware |

58% |

20% |

|

Virginia |

56% |

26% |

|

Oregon |

52% |

31% |

|

New Jersey |

51% |

35% |

|

New York |

49% |

30% |

In all, TikTok has been downloaded by a larger percentage of the population in 32 states, while Instagram is still leading in 13 states. The two apps are locked in a dead heat in the remaining 5 states.

It’s hard to make definitive conclusions about why TikTok is so popular in certain states over others.

TikTok is generally stronger in politically conservative states, while Instagram is generally stronger in politically liberal states.

In the 10 U.S. states where TikTok is strongest, 7 voted for Donald Trump in the popular vote by double digit margins in the 2020 election (Kentucky, Arkansas, West Virginia, Mississippi, Alabama, Louisiana, and Tennessee). The remaining 3 states where TikTok is strongest voted for Biden by slim margins (Nevada, New Mexico, and Iowa).

In the 10 U.S. states where Instagram is strongest, 9 voted for Joe Biden in the 2020 presidential election (Delaware, Virginia, Oregon, New Jersey, New York, District of Columbia, New Hampshire, Rhode Island, and Maryland). The remaining 1 state narrowly voted for Trump (Florida).

In an earlier analysis of political affiliation and mobile apps, Start.io found that nearly 44 percent of likely Democrats in the United States had downloaded Instagram, compared to roughly 35 percent of likely Republicans.

Outside of politics, the split might simply be geographic: TikTok is most popular in the South and the Midwest, while Instagram is most popular on the East Coast and the West Coast.

More on this dataset: Start.io routinely studies representative, anonymized consumer samples using first-party data that it gathers as part of its advertising SDK. In this dataset, Start.io studied 11 million Android users in the United States to build estimates of the relative mobile app download rates of TikTok, Instagram, and Facebook.

This dataset did not include iOS users, Android users who had opted out of sharing advertising data, or study session lengths or app open rates.

For more information about this dataset, or to activate it in your next advertising campaign, check out TikTok users in the United States.

Start.io’s mobile advertising SDK is installed on more than 500,000 active mobile apps worldwide and delivers digital ads to more than 2 billion people per month. Start.io gives advertisers powerful audience segmentation tools, and insights to help them build high-performing ad campaigns.

Reach out to learn more about Start.io’s audience segmentation and mobile monetization solutions.

Google kicked off the new year by forcing an estimated 30 million people to quit cookies for good—at least on the Web.

In early January, the company permanently cut off third-party cookies for roughly 1 percent of Google Chrome users. They’d like to turn off cookies on Chrome for all users by the end of the year.

This change represents a paradigm shift for the adtech industry, which spent decades building multibillion-dollar businesses on cookies and other advertising identifiers.

“For the user, [the death of cookies] is great,” Start.io Senior Vice President of Product & Engineering Andrew Younan said on a recent webinar hosted by AdExchanger. “The adtech industry will need to evolve to continue what they’re doing.”

Killing cookies is just the start: Similar privacy-centric policies are coming soon to Android. Within a few years, Google will put up walls that limit third-party access to user data across all Google products.

The death of cookies does not mean the death of targeted advertising, Start.io Chief Revenue Officer Ravit Ross said on the webinar.

“This is a massive shift for the industry, but it will create new opportunities for growth,” Ross said.

At a high level, Google devices and products have traditionally sent troves of consumer data to third-party software platforms, which used that data to build consumer profiles for ad targeting. On Chrome, this was done using third-party cookies, and on Android, it was done using Mobile Advertising IDs, or MAIDs.

In the future, consumer data will remain on the consumer’s device and won’t get shared with third-party companies. Instead, when someone lands on a website or opens a mobile app, their browser or mobile phone will share a limited set of the consumer’s interests—for example, hiking, running shoes, and their desire to buy a new family car.

Advertisers will use these interests provided by Google, augmented with other data from platforms like Start.io, to deliver relevant ads in real-time.

On the webinar, 46 percent of respondents said their companies were equally concerned about the deprecation of third-party cookies and MAIDs. Nearly half of respondents said they would rate their company’s readiness for this change at between 50 percent and 0 percent.

The majority said they planned to use both internal and external solutions to get their companies ready for the privacy shift.

A major opportunity lies in the return to publishers investing in first-party data for contextual targeting. For example, asking people to log in to their website or mobile app, and building unique consumer profiles based on the content they consume.

Watch the full conversation hosted by AdExchanger here: “2024 Trends and Planning – Introducing an ID-less World.”

Dzień dobry, Warszawa!

Start.io is expanding into Poland. Our new Warsaw location opened recently and is now our seventh site, joining locations in the U.S., Israel, Ukraine, the U.K., China, and India.

We’re currently hiring for several technical roles in Warsaw:

- Data Engineer (Infrastructure)

- Data Science & Engineering

- Data Scientist

- Professional Services Engineer

- QA Automation Lead

If you’re interested in joining us at Start.io, check out our full list of open roles now.

Poland is home to top universities and leading companies in the adtech, mobile, and gaming industries, and Start.io is expanding into the country to help support the company’s rapid growth.

Start.io wants to hire people who like tackling hard technical problems. We get millions of ad requests every second, and successfully deliver hundreds of millions of ads per day. Our ads routinely reach more than 2 billion people worldwide, and our engineers work on a platform that currently handles 2 petabytes of data per month.

The Engineering team at Start.io works closely with our Product and Business teams to develop, update, and maintain the infrastructure, platforms, and SDK that keeps the company’s advertising engine running smoothly. Our SDK is directly integrated into more than 500,000 active mobile apps.

Artificial intelligence sits at the core of our business and helps power real-time advertising decisions and ad campaign optimization.

Our Product and Engineering teams work in full collaboration with Start.io’s Business teams to deliver products that meet rigorous technical requirements and solve real challenges that our customers are facing.

Start.io has more than 100 employees, and roughly half work on our Engineering team. The team includes:

- Mobile and Web teams

- BE, DevOps and Platform teams

- Algorithm, Data Science and Data Engineering teams

- BI and BA teams

- Professional Services team

Start.io runs an agile organization that believes in transparency and full collaboration. We minimize bureaucracy and maximize individual ownership. Our model is to own it, build it, ship it, and support it. Many of our team members have built long and happy careers at Start.io, and we welcome you to learn more about our company culture.